Are you retired and rely on Social Security payments to, say, eat?

The attacks on Social Security benefits have been going on for longer than we’d like to think.

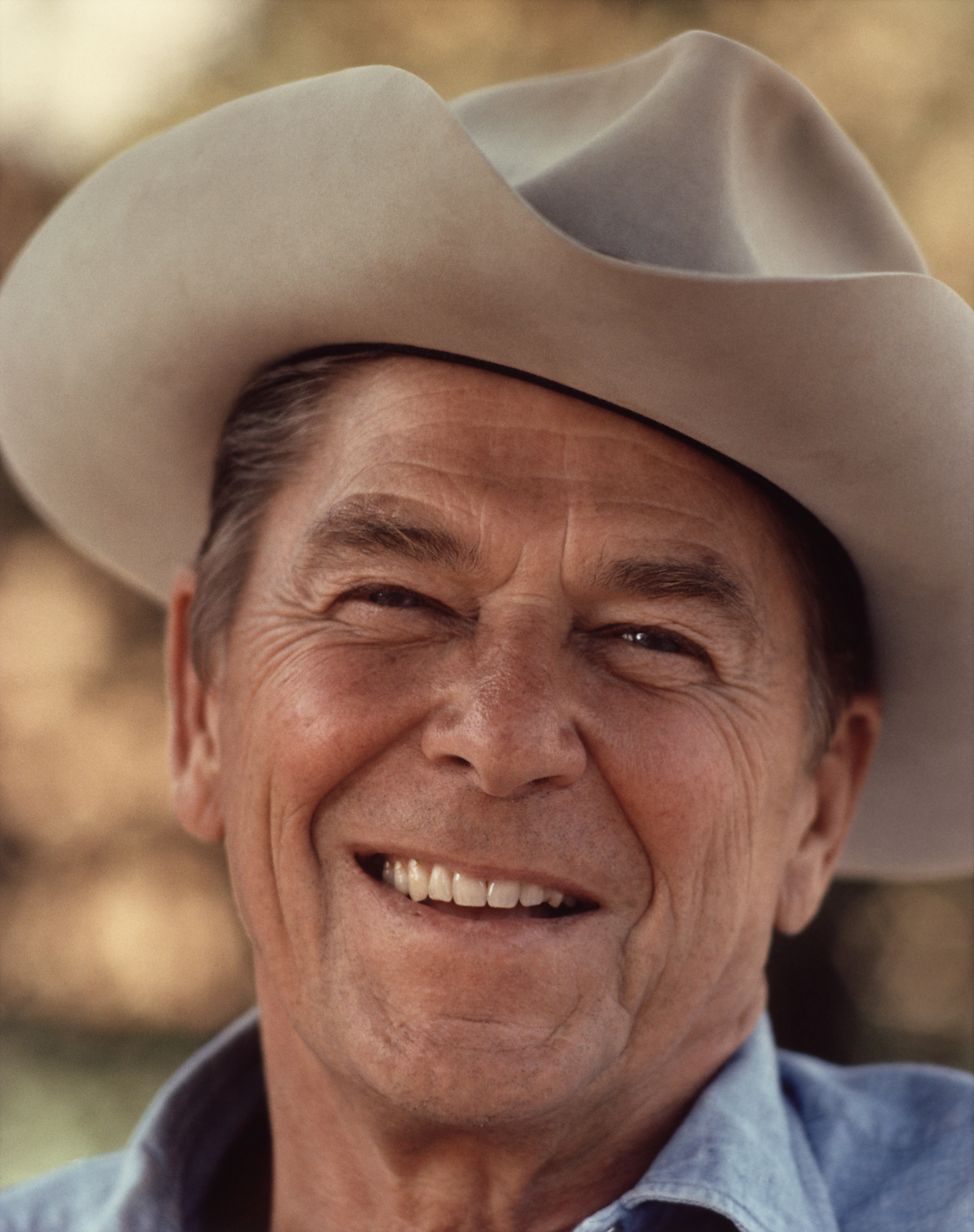

First, under the Reagan administration, SS benefits became taxable. The basic rule put in place was that up to 50% of Social Security benefits could be added to taxable income, if the taxpayer’s total income exceeded certain thresholds. This passed in Congress in 1983 on an overwhelmingly bi-partisan vote.

In 1993 (under Clinton), legislation was enacted which had the effect of increasing the tax put in place under the 1983 law. It raised from 50% to 85% the portion of Social Security benefits subject to taxation; but the increased percentage only applied to “higher income” beneficiaries. Beneficiaries of modest incomes might still be subject to the 50% rate, or to no taxation at all, depending on their overall taxable income. This one was deadlocked in the Senate until Al Gore cast the deciding vote to pass it. Thanks a lot, Al.

Enter Obama. Obama’s Executive Order 13531, technically called the “National Commission on Fiscal Responsibility and Reform,” formed what is commonly referred to as the Simpson-Bowles Commission. The commission report successfully tilted the discussion of Social Security to one of cutting benefits and raising the age limit. The recommendations were supported by both Democrats and Republicans. Luckily, there were senior advocates that fought hard to stop the momentum. “One of the ironies is that the tea party was more useful than Democratic leadership when it came to killing a grand bargain that would have cut Social Security benefits,” said Adam Green, co-chair of the Progressive Change Campaign Committee. “They were so crazy and unwilling to take ‘yes’ for an answer. That allowed us to live to fight another day.” Yet Obama used his 2014 budget plan to call for imposing a so-called chained CPIformula. That formula would reduce Social Security cost of living adjustments. Obama proposed the plan to help reduce the budget deficit, even though Social Security does not contribute to the deficit.

Yet Obama used his 2014 budget plan to call for imposing a so-called chained CPIformula, which would reduce Social Security cost of living adjustments. Obama proposed the plan to help reduce the budget deficit, even though Social Security does not contribute to the deficit. Thanks Obama.

How do we stop this attrition of Social Security benefits? Well, first, be aware of who you are voting for. This is not a Democrat vs Republican matter; both parties have been trying to cut benefits at one time or another. There are certain Senators, such as Bernie Sanders who are fighting hard to stop the downhill race and actually improve our situation.

Then there are those that see Social Security as some kind of blight on democracy; here are some articles to read:

Politicians aiming to cut Social Security and Medicare use weasel words to hide their plans.

FACT CHECK: Republican Candidates On Keeping Or Changing Social Security